We'd previously reflected on the opposing roles of visualization and presentation graphics; let's now examine how visualization graphics can help us analyze survey data.Visualization graphics can be used to quickly identify outliers within large quantities of data. Our brains are wired to recognize graphic differences in shape, magnitude, and direction more readily than we can recognize the equivalent differences within a table of numbers."Outliers" occur when the data visually rises above or below the average or the "noise" within the results. Outliers can serve as the source of the stories that an analyst constructs to offer understanding and explanation of the survey results. As an analyst you should be asking yourself "why?" when you observe an outlier.The more data you include within your visualization, the greater your odds of observing outliers. There is nothing wrong with creating a visual "rats nest" of lines or bars as part of the visual analysis. Your objective is to skim the edges of the data, ignoring the bulk of data that represents the average; you are visually filtering out the noise to identify the data observations that stand out from the fray.The radar chart below is a good example of a visualization of a large number of data points (156) summarizing hundreds of thousands of survey responses. Using this radar chart format, we can identify interesting outliers at a glance, much more conveniently than we could by studying a table or even a bar chart representation of this same data.

Here we are observing purchase decision importance survey questions results between six different brands rated by the survey respondents.At a glance we note the red line, represented of Brand E, displays considerable lower ratings than all other brands (i.e. "the noise") for the respondent's consideration of manufacturer's reputation, prestige of the product, prior experience with the manufacturer and technical innovations. Brand E may be a relatively new brand in the marketplace as purchasers did not consider reputation, prior experience or prestige as important criteria within their decision process.Alternatively, the blue line represented by Brand A sits above the noise for attribute fun to drive, but below the noise for attributes seating capacity and cargo space. Brand A may represent a manufacturer of sporty products that emphasize fun over practicality.Using this visualization, we have quickly identified outliers and have constructed hypothesis that we can then test and explore with our survey analysis drill down tools.In future posts, we will illustrate how to summarize the information we've gleaned from our visualization into a presentation graphic display, allowing us to communicate the story of our data to our customers.

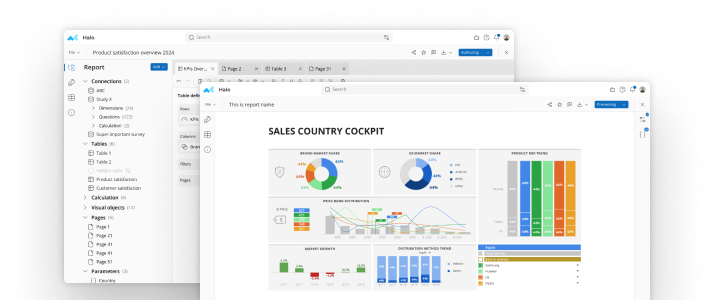

See mTab Halo in Action

Make smarter decisions faster with the world's #1 Insight Management System.